ESOPs have the most advantageous tax benefit.

A recent Price Waterhouse Coopers report indicated that 62% of the U.S. companies planning to sell all or part of

their business will do so within the next 5-6 years. U.S. Department of Commerce’s 2010 statistics show that

Pennsylvania’s Allegheny and the surrounding five counties account for 56,498 of non-farm privately held businesses,

many of whom fall into this 62% and are planning to transfer their businesses to their children and/or management.

However, the children and/or management often cannot afford to buy or borrow the funds needed to purchase the

business and an outright gift is not financially feasible for the seller.

An Employee Stock Ownership Plan (ESOP) is a tax-qualified retirement plan used for business transfers that often

results in the most after-tax seller proceeds than any other transfer method. Additionally, ESOPs are not affected

by the significant increased taxation on a sale of a business taking effect on January 1, 2013 yet still preserves

the family and community legacy of the business for generations to come.

Employee Stock Ownership Plans Defined

An ESOP is technically a defined contribution, tax-qualified retirement benefit plan designed to invest “primarily in

employer stock.” In practical terms, an ESOP has the most advantageous tax benefit transfer strategy for owners

desiring to take all or partial “chips of the table” that keeps out unrelated third parties and allows corporate

control to be transferred according to the seller’s timeline.

How an ESOP works

Typically, the ESOP borrows funds from a bank or the seller takes back a note. The company makes income

tax-deductible contributions to the ESOP which uses the funds to repay the loan incurred to buy the stock until the

debt is repaid. The shares purchased by the ESOP are allocated to the employees of the company in proportion to

their compensation as the loan is repaid.

ESOP Benefits

The seller enjoys an immediate buyer at full fair market value, may defer/eliminate all capital gains tax, and may

retain salary, perks, benefits and control. The corporation receives a dollar-for-dollar income tax deduction on the

entire stock sale price and may become a 100% federal and state income tax exempt entity. The employees receive

enhanced retirement benefits, with no out of pocket costs, work at a more stable employer and participate in

corporate growth as employee owners.

Corporate Governance and Control

Stock ownership and control are not synonymous in an ESOP company. In an ESOP company, the shares outside the ESOP

appoint the Board which names the ESOP Trustee. The trustee is usually directed by the board to ensure smooth

business operations. Therefore, control can be maintained by even a minority ownership.

ESOP’s Legacy Full Circle

Many owners want their children and/or management to eventually run and own the business, but they cannot afford to

purchase the business nor obtain adequate financing to do so. Additionally, the seller has often been a significant

contributor to the community by being a substantial employer, charitable benefactor and overall economic driver of

the town. The ESOP can preserve both the family and community legacies while still accomplishing the seller’s

transition goals and objectives.

Family/Management Legacy

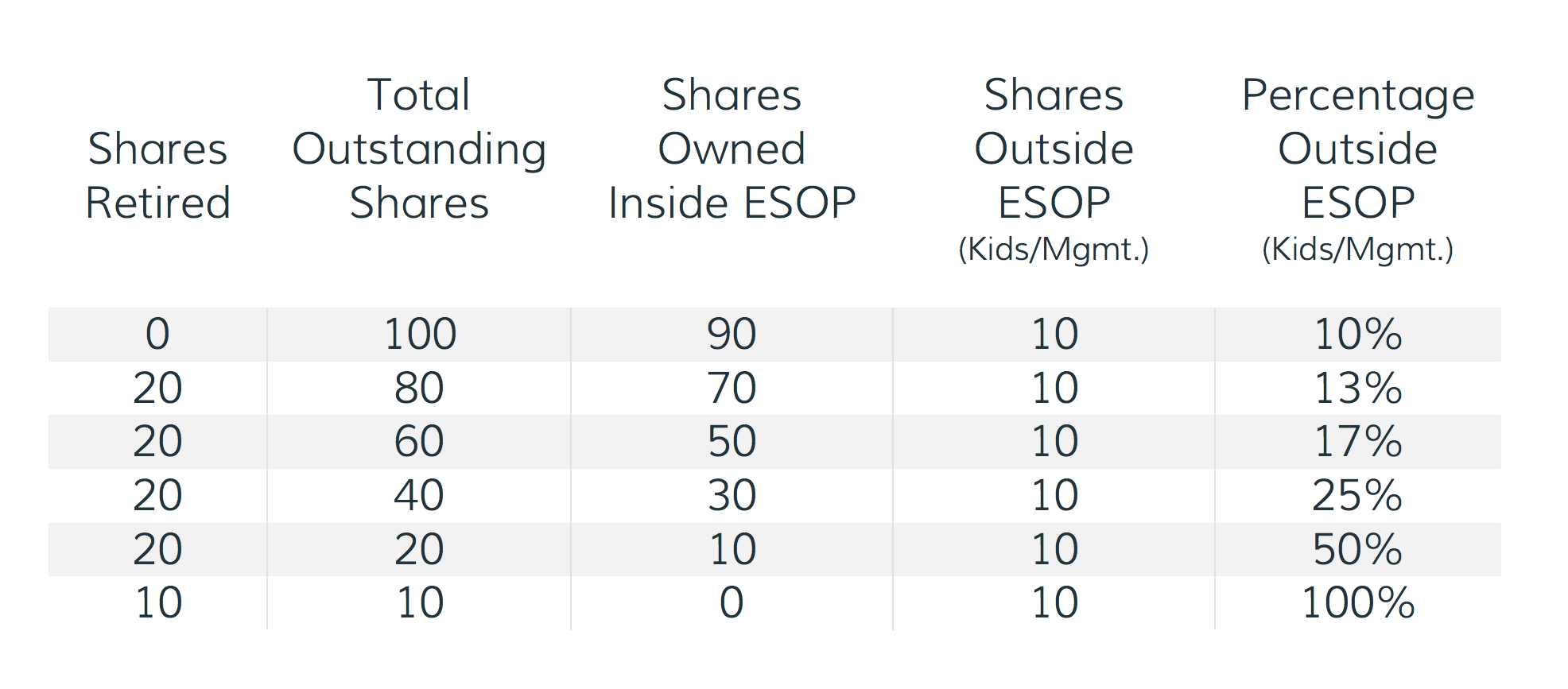

The seller can transfer control and/or ownership to the next generation at the seller’s discretion without the

interference of outside, unrelated interests. Control can be obtained by children and/or management with even a very

small interest. To increase actual ownership, the company can use corporate cash to purchase employees’ ESOP shares

as they leave the company and retire them into treasury. As the overall outstanding shares decreases, the percentage

of ownership that is held by outside the ESOP increases. In theory, when the last share is repurchased and retired,

the shares held outside the ESOP by the children and/management represents 100% of the value of the company, as

shown in the chart above.

Community Legacy

Studies show that ESOPs are a more stable employer that helps ensure the continuity of the level of the corporate

contribution to the community. Third party, out of town buyers are notorious for making decisions that negatively

affect the community such as consolidating operations, laying off duplicate divisions and even close local

operations and liquidate assets. The entire community may be including the employees, suppliers, charitable

beneficiaries, and professional service providers. In fact, many long-term business owners dread the idea of

retiring and living in a community decimated by the decisions of his/her buyer.

In summary, an ESOP is a ready and willing buyer and a highly tax-advantaged business transition tool. An ESOP may be

the ideal method to transfer a business on the seller’s timetable to the next generation without the interference

and costs of outside parties. As the window of record low capital gains rates are set to expire on December 31,

2012, baby boomer business owners in our region and around the country owe it to themselves to explore their options

including ESOP’s legacy full circle.